SAP Certified Associate – SAP S/4HANA 2021 for Financial Accounting

Achieve your SAP S/4HANA 2021 for Financial Accounting certification and validate your skills in core financial processes. This course prepares you for the exam and helps you land finance jobs in the SAP ecosystem

Unleash the Power of Financial Efficiency: Master SAP S/4HANA Financial Accounting

Tired of manual processes and siloed financial data? This comprehensive SAP S/4HANA 2021 for Financial Accounting course equips you with the skills to seamlessly integrate and automate your financial operations, unlocking a world of efficiency and control.

Become a sought-after financial whiz by learning to:

- Streamline core financial processes: Master accounts payable, receivable, general ledger, and closing tasks within the robust S/4HANA platform.

- Unify your financial data: Eliminate data silos and ensure smooth information flow across your entire financial ecosystem.

- Automate workflows: Free yourself and your team from repetitive tasks, saving valuable time and resources.

- Gain real-time financial insights: Generate accurate and insightful reports to make data-driven financial decisions.

This course is perfect for:

- Finance professionals looking to upskill in SAP S/4HANA

- Accountants seeking automation and efficiency gains

- Anyone looking to improve financial process control and decision-making

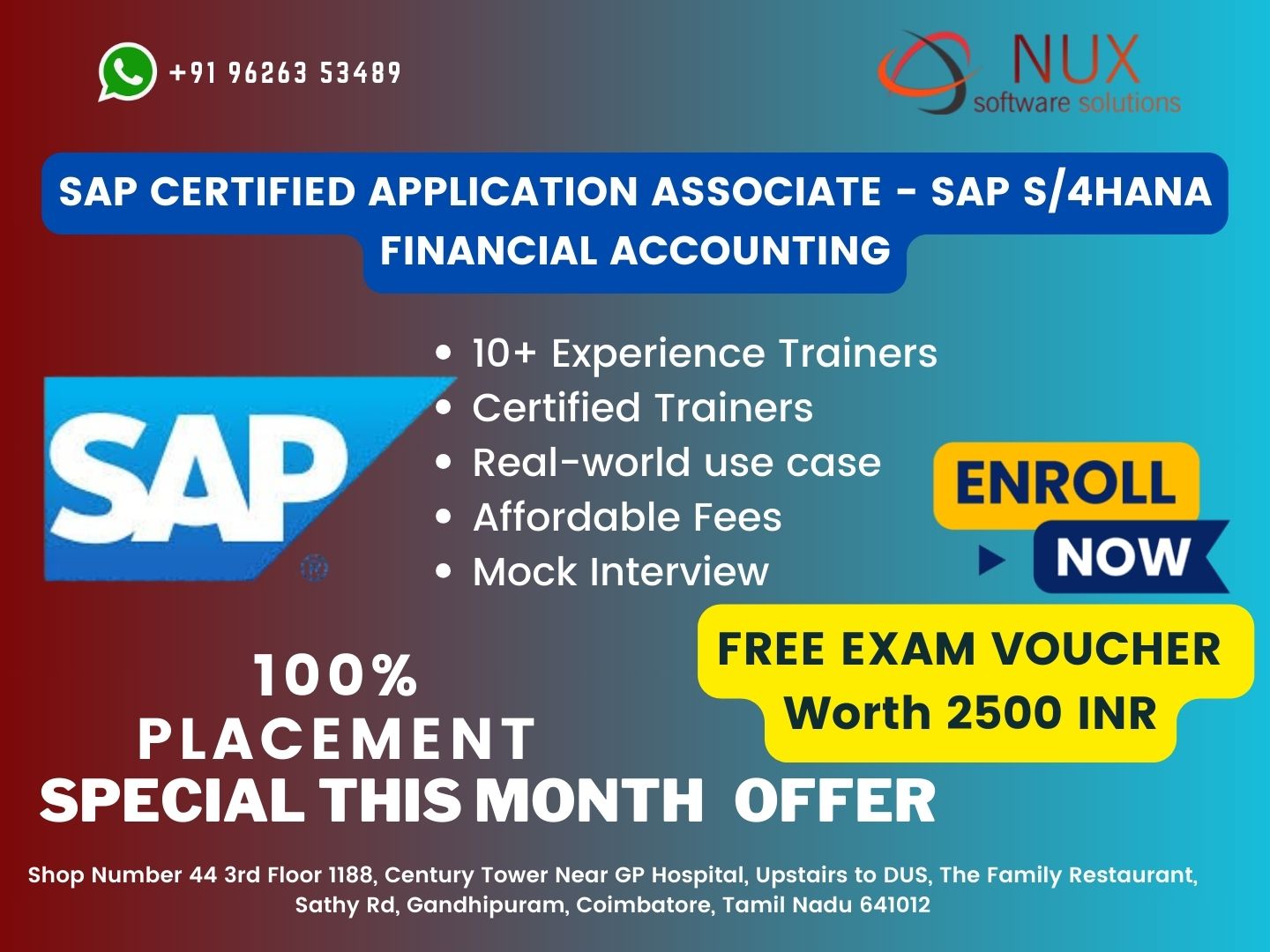

What sets us apart?

- Expert-led instruction: Gain practical knowledge from instructors with real-world SAP S/4HANA experience.

- Hands-on labs: Apply your newfound skills through interactive exercises and practice scenarios.

- Flexible learning options: Choose from in-person or online training to fit your schedule.

- Career-focused curriculum: Master the skills employers are looking for in today’s financial landscape.

Invest in your financial future by enrolling today!

SAP Certified Associate - SAP S/4HANA 2021 for Financial Accounting

Financial Closing > 12%

Perform month and year-end closing in Financial Accounting (exchange rate valuation, post provisions etc.), create balance sheet, create profit and loss statements, monitor closing operations using the Financial Closing Cockpit, post accruals with accrual documents and recurring entry documents, and manage posting periods.

General Ledger Accounting > 12%

Create and maintain general ledger accounts, exchange rates, bank master data and define house banks. Create and reverse general ledger transfer postings, post cross-company code transactions, create profit centers and segments. Clear an account and define and use a chart of accounts. Maintain tolerances, tax codes, and post documents with document splitting

Accounts Payable & Accounts Receivable > 12%

Create and maintain business partners, post invoices and payments and use special g/l transactions, reverse invoices and payments, block open invoices for payment, configure the payment program, and manage partial payments. Define the customizing settings for the Payment Medium Workbench, use the debit balance check for handling payments, define terms of payment and payment types, explain the connection of customers to vendors, describe integration with procurement and sales.

Asset Accounting > 12%

Create and maintain charts of depreciation and the depreciation areas, asset classes, asset master data, and configure and perform FI-AA business processes in the SAP system. Set up valuation and depreciation, perform periodic and year-end closing processes, and explain and configure parallel accounting.

Organizational Assignments and Process Integration > 12%

Manage Organizational Units, currencies, configure Validations and Document Types, utilize Reporting Tools, configure Substitutions, and manage Number ranges.

Overview and Deployment of SAP S/4HANA < 8%

Explain the SAP HANA Architecture and describe the SAP S/4HANA scope and deployment options.